The Significance of Bank Nifty Beyond Its Numerical Representation on Your Display

I engage in a morning ritual. Black coffee. A serene environment. And the flickering green and red lights signaling the market’s opening. For many years, I attempted to monitor everything simultaneously—the broad market, mid-cap stocks, and sectoral fluctuations. It was draining. It resembled the challenge of trying to hear every discussion in a bustling stadium. Ultimately, I discovered how to filter out the distractions and focus on a single, remarkably loud, frequently chaotic, yet perpetually intriguing conversation. The one conducted by the bank nifty.

It is not merely another index. Indeed. The Nifty 50 represents the esteemed, elegantly attired guest at the gathering, engaging in courteous discussions regarding diversified portfolios. In contrast, the Bank Nifty occupies a corner, fervently debating, laughing excessively, and spilling a drink. It embodies raw, unrefined sentiment concerning the Indian economy. Once you grasp its nuances, it reveals more than a multitude of headlines combined.

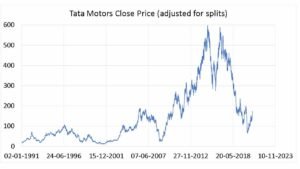

I have dedicated numerous hours observing a Nifty 50 chart alongside the Bank Nifty chart, and the narrative frequently resides in the gap between them. When they diverge, that is when the situation becomes particularly intriguing.

The Intense Pulse of the Indian Economy

Let me express it this way. If we consider the Indian economy as a living entity, then the banking sector in India serves as its circulatory system. It is the network that delivers the essential credit lifeblood to every segment of the economy, ranging from the largest corporations to the smallest retail borrowers. The Bank Nifty , commonly referred to as bank nifty, functions as the EKG connected to that system. It is sensitive and responsive. It is the first indicator of whether the heart is racing with enthusiasm or under stress regarding future developments.

This distinction highlights the fundamental difference in the debate between bank nifty and nifty 50. The Nifty 50 represents a broad, stabilizing blend of sectors including IT, FMCG, Oil & Gas, and indeed, Financials. It is diversified, exhibiting a slower response to both anger and celebration. In contrast, the Bank Nifty is a focused investment on a singular, potent concept: the financial stability and credit expansion of the nation. This focus results in an index that is remarkably volatile.

It is the market’s drama queen, and I use that term with the highest regard. It tends to overreact to announcements from the RBI. It either swoons or surges in response to inflation data. A vague statement from the US Federal Reserve can trigger a sharp decline, while a mere suggestion of a favorable monsoon can elevate it to euphoria. Observing its movements on a day filled with significant news is akin to witnessing a theatrical performance. It resembles a market on steroids.

What Exactly Is Contained Within This Item?

This is the aspect that many individuals overlook. They engage with the index without fully comprehending its intricacies. The components of the bank nifty are not all on equal footing. Not by a long shot. It comprises a collection of the 12 most liquid and substantial banking stocks, yet it is overwhelmingly influenced by a handful of private-sector behemoths.

It is crucial to grasp the significant impact of HDFC Bank and ICICI Bank. Their performance not only affects the index; on certain days, it essentially defines the index. If you find yourself questioning the behavior of the Bank Nifty, your initial action should be to observe the movements of these two banks. I frequently review brokerage analyses, and a report from a prominent entity such as HDFC Securities can provide profound insights into the specific stocks that drive this index. Understanding the status of these key players is vital. It is akin to attempting to gauge the mood of a royal court without being aware of the king’s sentiments. Good luck with that. For a more comprehensive analysis, the official NSE methodology page serves as an excellent, albeit somewhat dry, resource.

Then there are the PSU banks. The State Bank of India stands as a giant in its own right, yet the other public sector banks within the index often operate under a different rhythm, influenced more by government policies and news related to sovereign matters. They introduce a distinct type of volatility. Grasping this internal conflict between the private giants and the state-owned institutions is essential for genuinely understanding the character of the index. It resembles less a singular entity and more a highly dysfunctional, yet powerful, family.

Contemplating how a single corporation can sway an entire market index brings to mind how a new entrant can disrupt an entire ecosystem. Consider the financial sector; the introduction of something like the Jio Finance Share fundamentally alters the dynamics for existing players.

The Reasons You Cannot Afford to Overlook It

Even if you do not engage in direct trading, it is essential to monitor the Nifty Bank. Why is this important? Because it serves as a primary indicator. Banks do not merely respond to economic conditions; they frequently establish the circumstances that shape them.

When the Bank Nifty demonstrates strength and is on an upward trend, it indicates a level of confidence. This suggests that banks are extending credit, businesses are seeking loans, and the mechanisms of commerce are operating smoothly. It reflects a ‘risk-on’ sentiment. In contrast, when it is weak and declining, it acts as a warning signal. This implies a tightening of credit, apprehension regarding defaults (NPAs), and an overall atmosphere of ‘risk-off.’ Typically, it declines before the wider market does and often leads the recovery.

The overwhelming nature of it all can occasionally resemble a video game. The swift price fluctuations and the necessity for instantaneous decisions can feel less like investing and more akin to maneuvering through a level in Grand Theft Auto. However, beneath this turmoil lies a significant narrative regarding our collective trajectory. It encapsulates the story of India’s economic aspirations, unfolding in real-time, one tick at a time.

FAQ | Answers to Your Bank Nifty Inquiries

Is the Bank Nifty exclusively for professional day traders?

Not necessarily, but it certainly benefits those who are well-prepared. Due to its volatility, it attracts day traders who utilize futures and bank nifty options. Nevertheless, even for long-term investors, observing its trends offers essential insights into the state of the economy. One does not need to engage in trading to gain knowledge from it.

What is the most significant error individuals commit regarding this index?

Entering the market without acknowledging its volatility. Numerous novice traders observe the significant price fluctuations and assume it is a straightforward method to earn quick profits. They often invest with insufficient capital and neglect to set a stop-loss, which can result in the index eliminating their investments within minutes. The most critical error is failing to recognize its potential impact.

What causes the Bank Nifty to occasionally exhibit such distinct movements compared to the Nifty 50?

This relates to the composition. A poor day for the IT sector could pull the Nifty 50 down; however, if there is favorable news regarding interest rates, the bank nifty may indeed rise. Being a specialized index, it reacts significantly to news pertinent to the banking sector in India, while the Nifty 50 must consider news from ten distinct sectors.

How can I begin to comprehend the process of trading in Bank Nifty?

Engage in paper trading initially. It is crucial. Utilize a simulator for practice. Observe the market for several weeks. Analyze its responses to news events. Familiarize yourself with its significant support and resistance levels. Gain knowledge about the components of the bank nifty and monitor the major players. Refrain from risking any actual money until you are confident in your understanding of its behavior.

Is examining a nifty 50 chart sufficient, or is it necessary for me to monitor the Bank Nifty in particular?

For passive, long-term investors in a diversified fund, the Nifty 50 chart is likely adequate. However, for those who are active investors or traders, or for anyone seeking a more profound comprehension of market dynamics, neglecting the Bank Nifty is akin to watching a film without sound. You are missing a significant portion of the narrative.

Ultimately, my interest in this index transcends mere numbers. It stems from the fact that the Bank Nifty serves as a raw, unrefined indicator of our shared economic aspirations and anxieties. It encapsulates the story of a nation in haste, portrayed through the vigorous movements of bulls and bears. For anyone endeavoring to grasp India’s economic trajectory, it is a narrative that deserves attention.